Tax Benefits

Earn Bitcoin & Save

Big on your Taxes.

Earn Bitcoin & Save

Big on your Taxes.

Earn Bitcoin & Save

Big on your Taxes.

Turn your investment into immediate tax savings while earning Bitcoin. Hashbranch's enterprise mining platform qualifies for Section 179 and bonus depreciation, deduct up to 100% of equipment costs in year one.

Turn your investment into immediate tax savings while earning Bitcoin. Hashbranch's enterprise mining platform qualifies for Section 179 and bonus depreciation, deduct up to 100% of equipment costs in year one.

Turn your investment into immediate tax savings while earning Bitcoin. Hashbranch's enterprise mining platform qualifies for Section 179 and bonus depreciation, deduct up to 100% of equipment costs in year one.

Mine with Hashbranch

You saved $87,000 in tax Savings!

Your Investment

$247,000

Your tax rate

35%

Your total savings

$87,000

You saved $87,000 in tax Savings!

Your Investment

$247,000

Your tax rate

35%

Your total savings

$87,000

You saved $87,000 in tax Savings!

Your Investment

$247,000

Your tax rate

35%

Your total savings

$87,000

You saved $87,000 in tax Savings!

Your Investment

$247,000

Your tax rate

35%

Your total savings

$87,000

Tax Savings & Bitcoin Returns

Tax Savings & Bitcoin Returns

$1 Million Investment

$1 Million Investment

Deal Pro Forma & Projected Outcomes

Deal Pro Forma & Projected Outcomes

Investment

Projected Tax Savings

Projected Tax Savings

Projected

IRR

Projected

IRR

Projected Multiple on Invested Capital

Projected Multiple on Invested Capital

Projected

Breakeven Time

Projected

Breakeven Time

Example*

$1 Million

Up to $500K

Up to $500K

31.2%

31.2%

1.97

1.97

27 Months

27 Months

Market assumptions: Network difficulty growth 1%/mo, BTC price growth 2%/mo, exit date April 1st, 2028.

Based on market data: November 13th, 2025 BTC at $102,100, Hashprice $43/PH.

Fleet assumptions: 127 x MicroBT M63S++ Hydro (58.9PH), $7192/unit, 60 month hardware depreciation, US hosting $0.0725/kWh, 95% uptime.

How It Works

How It Works

Turn your tax bill into productive bitcoin mining hardware

Turn your tax bill into productive bitcoin mining hardware

Turn your tax bill into productive bitcoin mining hardware

Under H.R. 1 (effective Jan 19, 2025), investors can write off mining hardware using Section 179 and 100% Bonus Depreciation. This lowers taxes while deploying income-producing assets.

Bonus Depreciation

The One Big Beautiful Bill Act (OBBBA)

Allows 100% expensing of qualified property placed in service after Jan 19, 2025, including new and used ASICs. There are no limits to how much can be expensed.

Bonus Depreciation

The One Big Beautiful Bill Act (OBBBA)

Allows 100% expensing of qualified property placed in service after Jan 19, 2025, including new and used ASICs. There are no limits to how much can be expensed.

Bonus Depreciation

The One Big Beautiful Bill Act (OBBBA)

Allows 100% expensing of qualified property placed in service after Jan 19, 2025, including new and used ASICs. There are no limits to how much can be expensed.

Section 179

Lets you deduct up to $2.5M in equipment (phase-out at $4M), limited to business income and cannot create a loss.

Section 179

Lets you deduct up to $2.5M in equipment (phase-out at $4M), limited to business income and cannot create a loss.

Section 179

Lets you deduct up to $2.5M in equipment (phase-out at $4M), limited to business income and cannot create a loss.

Tax Deduction Estimates*

Taxable rate(%)

Mining Investment

35%

45%

50%

$100,000

$35,000

$45,000

$50,000

$250,000

$87,500

$112,500

$125,000

$500,000

$175,000

$225,000

$250,000

$1,000,000

$350,000

$450,000

$500,000

*This chart is speculative, illustrative, and not based on actual forecasts. It should not be interpreted as financial advice or an indication of future BTC prices. BTC is highly volatile, and this chart should not be relied upon for any investment decisions. Consult with a qualified CPA to determine eligibility and proper application of tax rules. State laws and individual circumstances may vary.

*Based on Combined state and federal tax rate

Qualification Criteria & Rules

Qualification Criteria & Rules

ASIC miners must be used in a real trade or business

Hardware must be online and generating income in the tax year

New and used units qualify if used >50% for business

Qualified hosting fees (power, rack space) are also deductible

Equipment must be live, individuals must input 100+ hours a year of active involvement and separately equipment must be live before the end of the tax year. Recapture applies if business use drops or units are sold early. Check state rules with your CPA.

Equipment must be live, individuals must input 100+ hours a year of active involvement and separately equipment must be live before the end of the tax year. Recapture applies if business use drops or units are sold early. Check state rules with your CPA.

Our Process

Hashbranch manages deployment, tracks service dates, and stores all records needed for audit-ready CPA filings, including Form 4562. Our process is below:

Consult

on your tax goals and hardware plan

Deploy

Deploy hardware in vetted US mining facilities

File

deductions using our documentation

Optimize

with full lifecycle tracking and redeploy support

Consult

on your tax goals and hardware plan

Deploy

Deploy hardware in vetted US mining facilities

File

deductions using our documentation

Optimize

with full lifecycle tracking and redeploy support

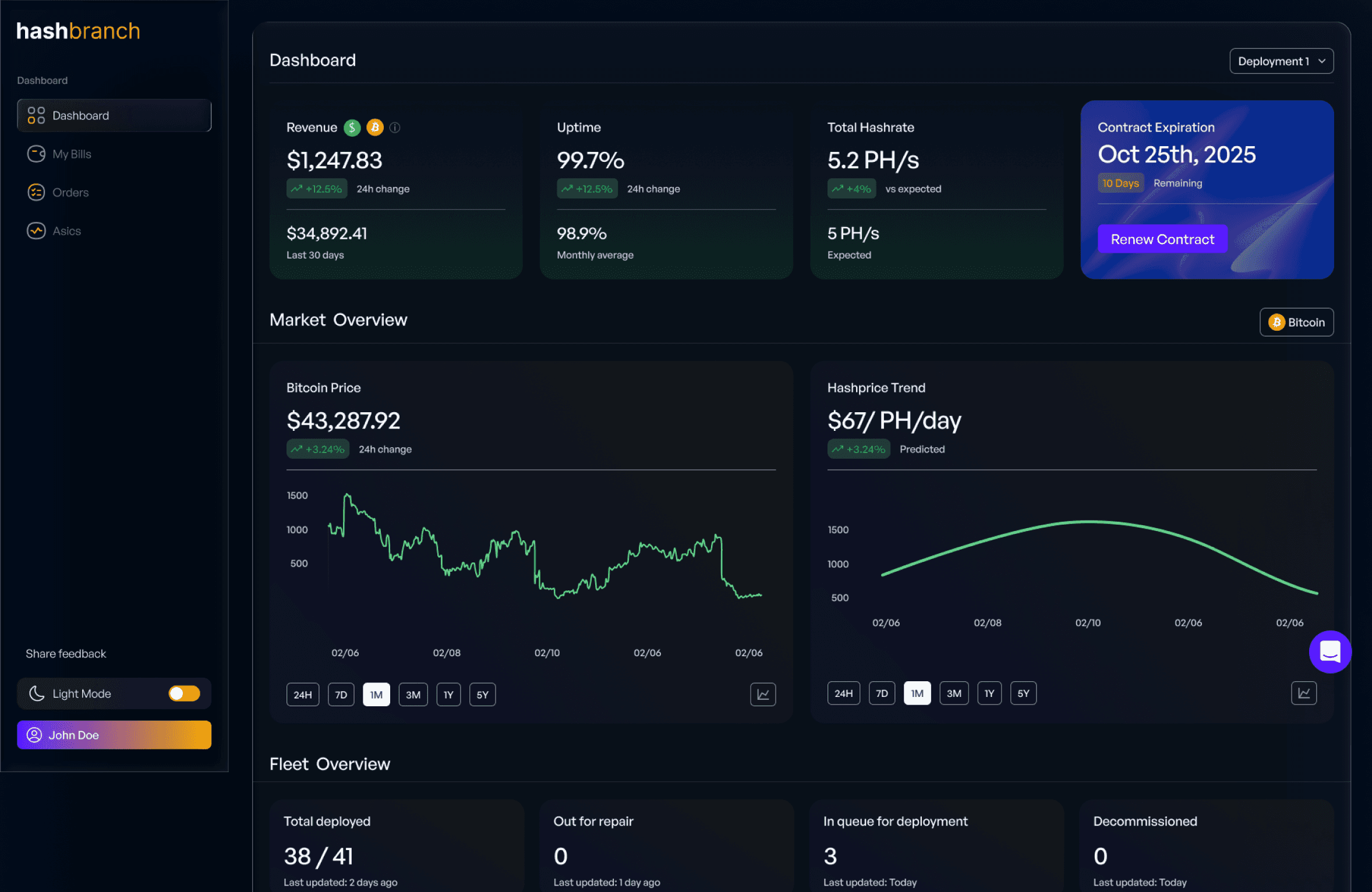

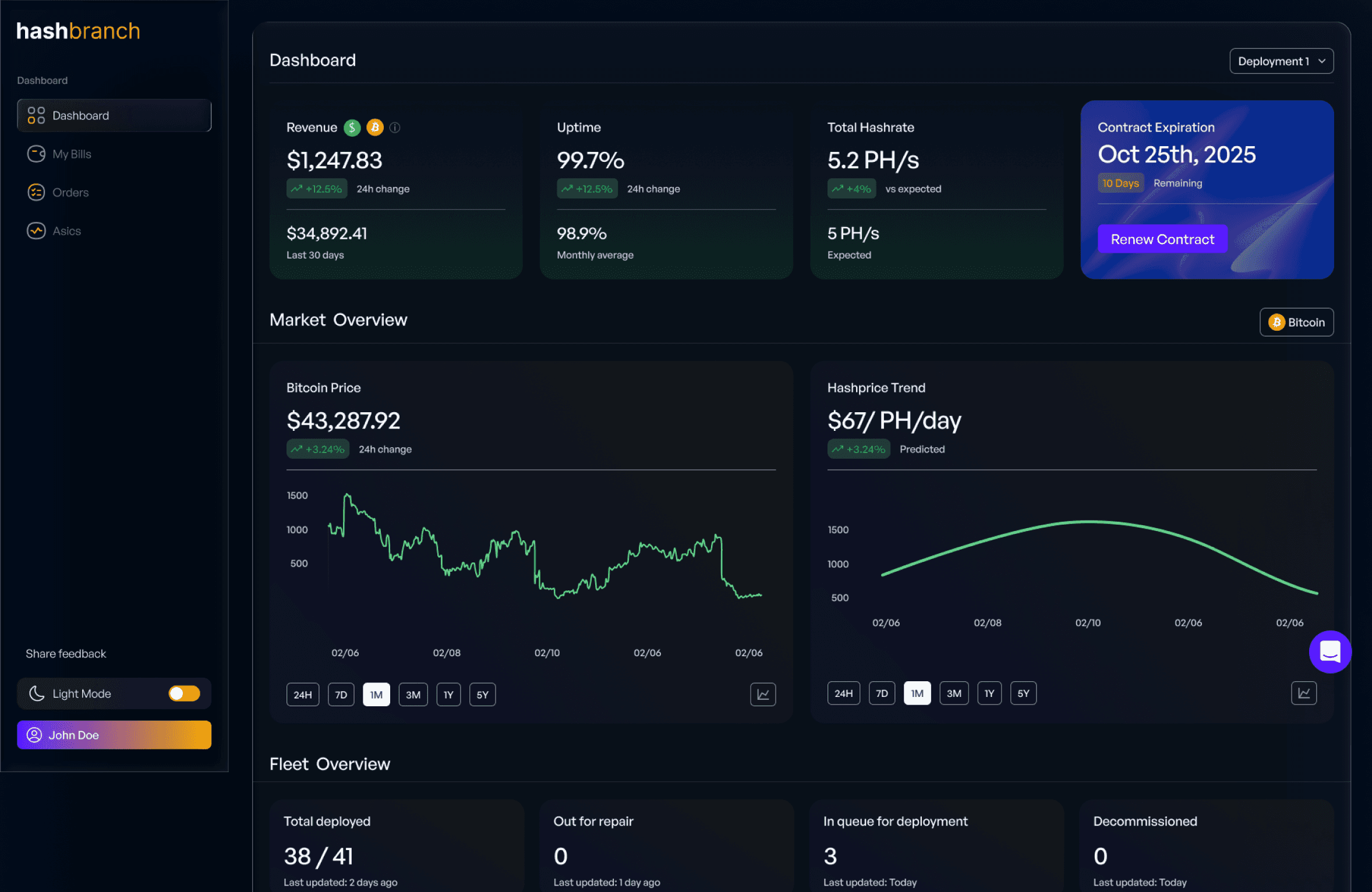

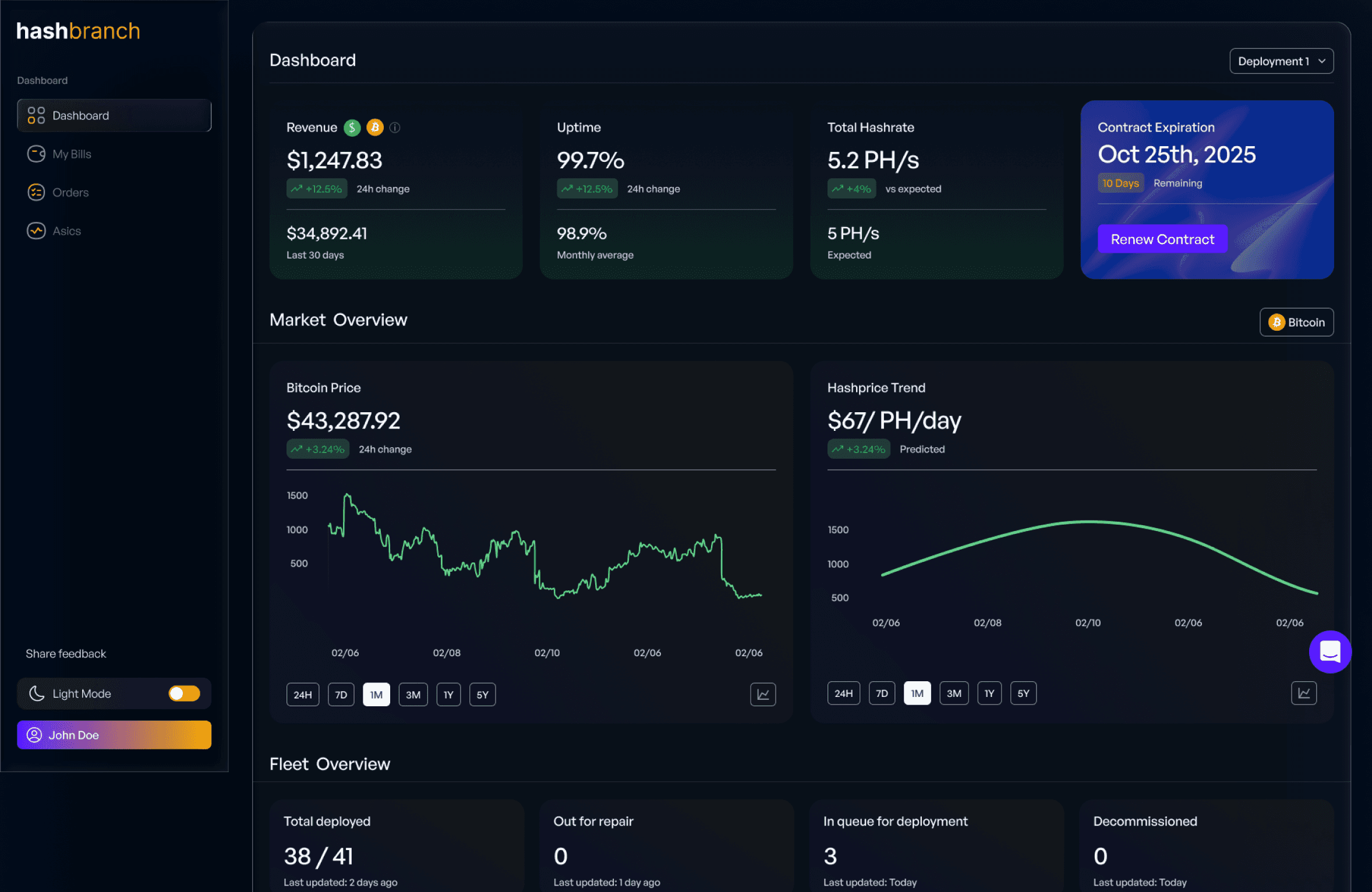

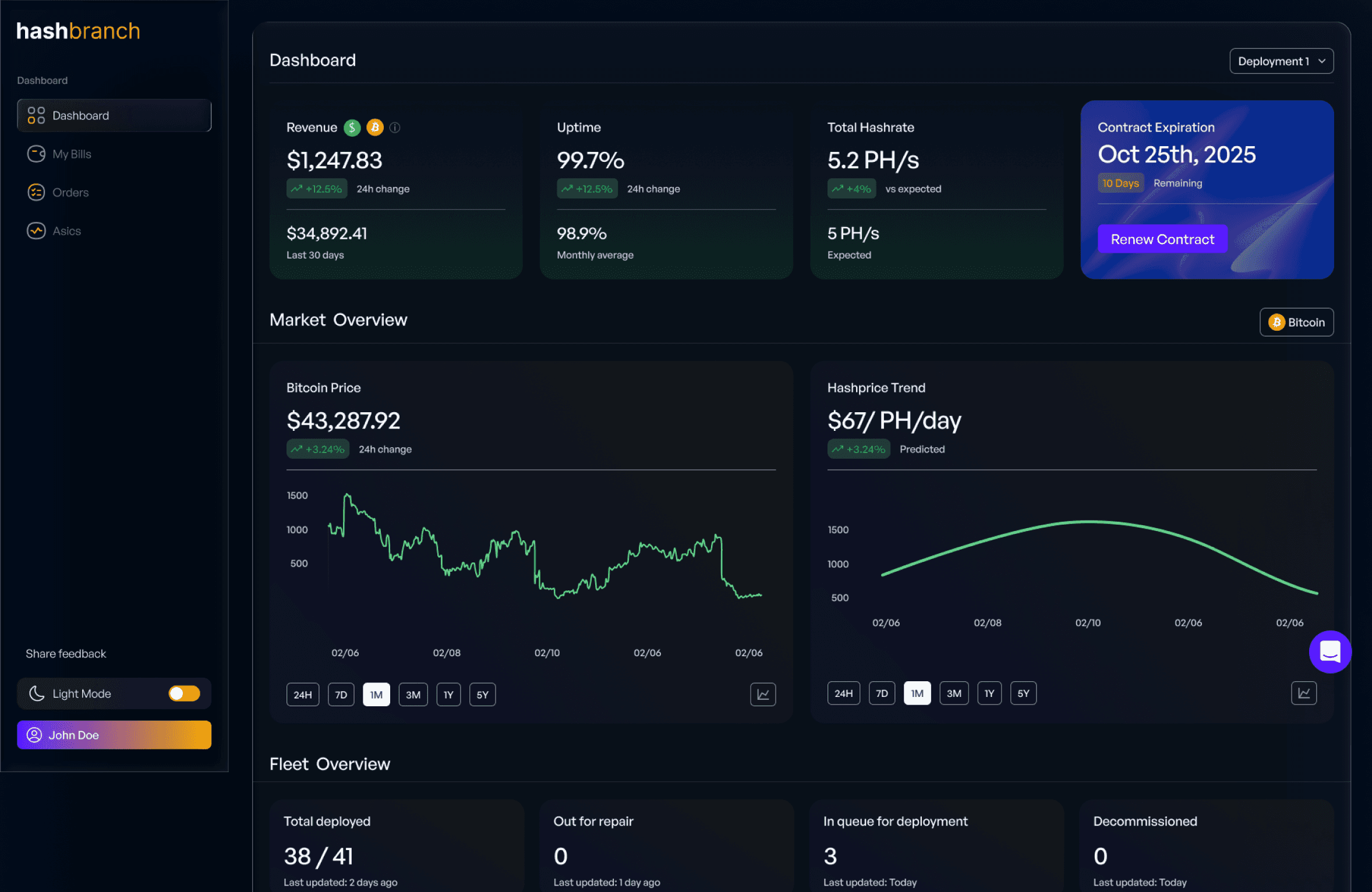

Your Command Center

Dashboard & Fleet Support

Dashboard & Fleet Support

Dashboard & Fleet Support

Access to your live dashboard

Scale confidently with centralized reporting, unified legal, and redeploy options. We manage administration and strategy while facilities execute hands-on operations and maintenance.

Dedicated fleet management support

Scale confidently with centralized reporting, unified legal, and redeploy options. We manage administration and strategy while facilities execute hands-on operations and maintenance.

Proven Results

Proven Results

Hashbranch powers institutional-grade mining across the U.S. by combining enterprise hardware brokerage with fully managed hosting. Our platform supports thousands of users and machines while being built to maximize uptime, profit, and simplicity.

Hashbranch powers institutional-grade mining across the U.S. by combining enterprise hardware brokerage with fully managed hosting. Our platform supports thousands of users and machines while being built to maximize uptime, profit, and simplicity.

14,000+

ASICs Deployed & Hosted

30+ MW

currently under management with centralized reporting

14,000+

ASICs Deployed & Hosted

30+ MW

currently under management with centralized reporting

Why Choose Us

Why Partner with Hashbranch?

One Platform

One Platform

Tracks every unit, site, and metric in a single dashboard.

OH

WY

TX

CA

One Contract

One Contract

Simplified legal that covers multiple partner facilities in the USA.

Brandon

Yesterday

Hey, I’m Brandon your Dedicated Account Manager and I’m here if you need to discuss anything

Today

Sure, I actually wanted to know how I can switch my payments to Stripe and enable Autopay

I’m sharing a meet link and we can discuss this over a call

Dedicated Account Manager

Dedicated Account Manager

Your expert partner for deployment strategy, facility selection, and ongoing optimization.

TX

WY

OH

GA

Vetted U.S. Facilities

Vetted U.S. Facilities

Power, cooling, and uptime from proven partners only.

Full-Stack Support

Full-Stack Support

Includes strategy, logistics, onboarding, & continuous optimization.

Profit Protection

Profit Protection

Identifies and moves low-performing fleets to boost efficiency and returns.

Antminer S21+

Sell Now

TX

Rack A1

10.10.81.92:

Liquidity on Demand

Helps sell, refresh, or upgrade units when the market shifts or you need cash flow.

Our partners provide power and infrastructure. hashbranch provides strategy, operations, & monitoring.

Get in touch

Dedicated Account Manager

Your expert partner for deployment strategy, facility selection, and ongoing optimization.

Brandon

Yesterday

Hey, I’m Brandon your Dedicated Account Manager and I’m here if you need to discuss anything

Today

Sure, I actually wanted to know how I can switch my payments to Stripe and enable Autopay

I’m sharing a meet link and we can discuss this over a call

One Contract

Simplified legal that covers multiple partner facilities in the USA.

OH

WY

TX

CA

One Platform

Tracks every unit, site, and metric in a single dashboard.

Vetted U.S. Facilities

Power, cooling, and uptime from proven partners only.

TX

WY

OH

GA

Liquidity on Demand

Helps sell, refresh, or upgrade units when the market shifts or you need cash flow.

Antminer S21+

Sell Now

TX

Rack A1

10.10.81.92:

Full-Stack Support

Includes strategy, logistics, legal, onboarding, & continuous optimization.

Profit Protection

Identifies and moves low-performing fleets to boost efficiency and returns.

Dedicated Account Manager

Your expert partner for deployment strategy, facility selection, and ongoing optimization.

Brandon

Yesterday

Hey, I’m Brandon your Dedicated Account Manager and I’m here if you need to discuss anything

Today

Sure, I actually wanted to know how I can switch my payments to Stripe and enable Autopay

I’m sharing a meet link and we can discuss this over a call

One Contract

Simplified legal that covers multiple partner facilities in the USA.

OH

WY

TX

CA

One Platform

Tracks every unit, site, and metric in a single dashboard.

Vetted U.S. Facilities

Power, cooling, and uptime from proven partners only.

TX

WY

OH

GA

Liquidity on Demand

Helps sell, refresh, or upgrade units when the market shifts or you need cash flow.

Antminer S21+

Sell Now

TX

Rack A1

10.10.81.92:

Full-Stack Support

Includes strategy, logistics, legal, onboarding, & continuous optimization.

Profit Protection

Identifies and moves low-performing fleets to boost efficiency and returns.

Dedicated Account Manager

Your expert partner for deployment strategy, facility selection, and ongoing optimization.

Brandon

Yesterday

Hey, I’m Brandon your Dedicated Account Manager and I’m here if you need to discuss anything

Today

Sure, I actually wanted to know how I can switch my payments to Stripe and enable Autopay

I’m sharing a meet link and we can discuss this over a call

One Contract

Simplified legal that covers multiple partner facilities in the USA.

OH

WY

TX

CA

One Platform

Tracks every unit, site, and metric in a single dashboard.

Vetted U.S. Facilities

Power, cooling, and uptime from proven partners only.

TX

WY

OH

GA

Liquidity on Demand

Helps sell, refresh, or upgrade units when the market shifts or you need cash flow.

Antminer S21+

Sell Now

TX

Rack A1

10.10.81.92:

Full-Stack Support

Includes strategy, logistics, legal, onboarding, & continuous optimization.

Profit Protection

Identifies and moves low-performing fleets to boost efficiency and returns.

Dedicated Account Manager

Your expert partner for deployment strategy, facility selection, and ongoing optimization.

Brandon

Yesterday

Hey, I’m Brandon your Dedicated Account Manager and I’m here if you need to discuss anything

Today

Sure, I actually wanted to know how I can switch my payments to Stripe and enable Autopay

I’m sharing a meet link and we can discuss this over a call

One Contract

Simplified legal that covers multiple partner facilities in the USA.

OH

WY

TX

CA

One Platform

Tracks every unit, site, and metric in a single dashboard.

Vetted U.S. Facilities

Power, cooling, and uptime from proven partners only.

TX

WY

OH

GA

Liquidity on Demand

Helps sell, refresh, or upgrade units when the market shifts or you need cash flow.

Antminer S21+

Sell Now

TX

Rack A1

10.10.81.92:

Full-Stack Support

Includes strategy, logistics, legal, onboarding, & continuous optimization.

Profit Protection

Identifies and moves low-performing fleets to boost efficiency and returns.

Subscribe to our newsletter.

Subscribe to our newsletter.

Email Address

Subscribe

Popular questions

Popular questions

Learn more about Hashbranch

Learn more about Hashbranch

How can Bitcoin mining help me reduce my tax bill

How can Bitcoin mining help me reduce my tax bill

How can Bitcoin mining help me reduce my tax bill

How can Bitcoin mining help me reduce my tax bill

What is bonus depreciation and how does it apply to mining equipment

What is bonus depreciation and how does it apply to mining equipment

What is bonus depreciation and how does it apply to mining equipment

What is bonus depreciation and how does it apply to mining equipment

How does Section 179 expensing work for Bitcoin miners

How does Section 179 expensing work for Bitcoin miners

How does Section 179 expensing work for Bitcoin miners

How does Section 179 expensing work for Bitcoin miners

How is mining different from simply buying Bitcoin in terms of taxes

How is mining different from simply buying Bitcoin in terms of taxes

How is mining different from simply buying Bitcoin in terms of taxes

How is mining different from simply buying Bitcoin in terms of taxes

What kind of tax savings are possible on a one million dollar mining investment

What kind of tax savings are possible on a one million dollar mining investment

What kind of tax savings are possible on a one million dollar mining investment

What kind of tax savings are possible on a one million dollar mining investment

What assumptions go into the tax deduction estimate table

What assumptions go into the tax deduction estimate table

What assumptions go into the tax deduction estimate table

What assumptions go into the tax deduction estimate table

Who qualifies to use these mining related tax strategies

Who qualifies to use these mining related tax strategies

Who qualifies to use these mining related tax strategies

Who qualifies to use these mining related tax strategies

What are the key rules and criteria I should be aware of

What are the key rules and criteria I should be aware of

What are the key rules and criteria I should be aware of

What are the key rules and criteria I should be aware of

How does Hashbranch help me plan around tax deadlines and deployment timing

How does Hashbranch help me plan around tax deadlines and deployment timing

How does Hashbranch help me plan around tax deadlines and deployment timing

How does Hashbranch help me plan around tax deadlines and deployment timing

What does the “Turn your tax bill into productive Bitcoin mining hardware” idea really mean

What does the “Turn your tax bill into productive Bitcoin mining hardware” idea really mean

What does the “Turn your tax bill into productive Bitcoin mining hardware” idea really mean

What does the “Turn your tax bill into productive Bitcoin mining hardware” idea really mean

How risky is it to rely on tax benefits as part of a mining strategy

How risky is it to rely on tax benefits as part of a mining strategy

How risky is it to rely on tax benefits as part of a mining strategy

How risky is it to rely on tax benefits as part of a mining strategy

Does Hashbranch give tax advice or file returns for clients

Does Hashbranch give tax advice or file returns for clients

Does Hashbranch give tax advice or file returns for clients

Does Hashbranch give tax advice or file returns for clients

What kind of data will my accountant need from my mining operation

What kind of data will my accountant need from my mining operation

What kind of data will my accountant need from my mining operation

What kind of data will my accountant need from my mining operation

How does the process work if I want to use mining as a tax strategy this year

How does the process work if I want to use mining as a tax strategy this year

How does the process work if I want to use mining as a tax strategy this year

How does the process work if I want to use mining as a tax strategy this year

What is the best way to find out if this approach fits my specific tax situation

What is the best way to find out if this approach fits my specific tax situation

What is the best way to find out if this approach fits my specific tax situation

What is the best way to find out if this approach fits my specific tax situation

Tax Deduction Estimates*

Tax Deduction Estimates*

Taxable rate(%)

$100,000 Mining

Investment

35% →

$35,000

45% →

$45,000

50% →

$50,000

$100,000 Mining

Investment

35% →

$35,000

45% →

$45,000

50% →

$50,000

$100,000 Mining

Investment

35% →

$35,000

45% →

$45,000

50% →

$50,000

$250,000 Mining

Investment

35% →

$87,500

45% →

$112,500

50% →

$125,000

$250,000 Mining

Investment

35% →

$87,500

45% →

$112,500

50% →

$125,000

$250,000 Mining

Investment

35% →

$87,500

45% →

$112,500

50% →

$125,000

$500,000 Mining

Investment

35% →

$175,000

45% →

$225,000

50% →

$250,000

$500,000 Mining

Investment

35% →

$175,000

45% →

$225,000

50% →

$250,000

$500,000 Mining

Investment

35% →

$175,000

45% →

$225,000

50% →

$250,000

$1,000,000 Mining

Investment

35% →

$350,000

45% →

$450,000

50% →

$500,000

$1,000,000 Mining

Investment

35% →

$350,000

45% →

$450,000

50% →

$500,000

$1,000,000 Mining

Investment

35% →

$350,000

45% →

$450,000

50% →

$500,000

*This chart is speculative, illustrative, and not based on actual forecasts. It should not be interpreted as financial advice or an indication of future BTC prices. BTC is highly volatile, and this chart should not be relied upon for any investment decisions. Consult with a qualified CPA to determine eligibility and proper application of tax rules. State laws and individual circumstances may vary.

*Based on Combined state and federal tax rate

Hashbranch is the #1 hosting platform for U.S. Bitcoin mining. Our end-to-end platform provides investors with verified hardware, enterprise-grade hosting, and software-driven lifecycle management. We've built this to maximize yield, reduce operational risk, and extend asset longevity.

Request an AI summary of Hashbranch

© Hashbranch Inc. 2026. All rights reserved.

Hashbranch is the #1 hosting platform for U.S. Bitcoin mining. Our end-to-end platform provides investors with verified hardware, enterprise-grade hosting, and software-driven lifecycle management. We've built this to maximize yield, reduce operational risk, and extend asset longevity.

Request an AI summary of Hashbranch

© Hashbranch Inc. 2026. All rights reserved.

Hashbranch is the #1 hosting platform for U.S. Bitcoin mining. Our end-to-end platform provides investors with verified hardware, enterprise-grade hosting, and software-driven lifecycle management. We've built this to maximize yield, reduce operational risk, and extend asset longevity.

Request an AI summary of Hashbranch

© Hashbranch Inc. 2026. All rights reserved.

Hashbranch is the #1 hosting platform for U.S. Bitcoin mining. Our end-to-end platform provides investors with verified hardware, enterprise-grade hosting, and software-driven lifecycle management. We've built this to maximize yield, reduce operational risk, and extend asset longevity.

Request an AI summary of Hashbranch

© Hashbranch Inc. 2026. All rights reserved.